President Trump's Tariffs are Legal

Liberal Activist Courts Fight to Derail American Reindustrialization

In light of the new wave of liberal lawfare being waged against President Trump’s tariffs, it’s worth considering: do the liberals have a point?

Rand Paul certainly thought so—recall that a few weeks ago he brought the Senate to a tiebreaking vote to halt the tariffs.

This is because Article 1, Section 8, Clause 1 of the Constitution explicitly grants Congress the power to “lay and collect Taxes, Duties, Imposts and Excises” and to “regulate Commerce with foreign Nations”. Strictly speaking, Congress has these powers—not the Executive.

However, Congress also has the authority to delegate powers to the Executive for specific purposes. This is typically done because everyone knows—even corrupt congressmen—that the Executive is both far more responsive and nimble than Congress, and carries out the duties on the ground. Accordingly, the Executive is often better suited to exercise certain congressional powers.

In that vein, Congress has delegated—authorized—the Executive significant powers over tariffs.

A Brief Review of the President’s Delegated Authority on Tariffs

The International Emergency Economic Powers Act of 1977 provides the President with broad powers over commerce in cases of national emergency. This is why President Trump declared fentanyl smuggling to be a national emergency before imposing the first round of tariffs under this authority.

The legal questions swirling around this authority include whether fentanyl smuggling constitutes a national emergency, and whether broad-reaching tariffs are a relevant and proportional remedy to the issue.

Given that over 50,000 Americans die every year from opioid overdoses—and a further 25,000 from other drugs smuggled over the borders—it seems to me that this indeed constitutes a national emergency. Consider that Hurricane Katrina—unequivocally a national emergency—killed 1,392 people.

In terms of the remedy, I don’t see how you could possibly attempt to solve this problem without tariffs—in particular by eradicating the de minimis exemption through which these drugs are smuggled.

The reality is that an estimated $1.4 billion worth of goods came in through the de minimis exemption in 2024—this includes a significant portion of the fentanyl. Why? Because these goods came in under the radar. President Trump was right and justified in addressing the fentanyl crisis, and tariffs and eliminating the de minimis exemption are reasonable steps to take to address the crisis.

Another important example is Section 232 of the Trade Expansion Act of 1962 authorizes the President to impose tariffs if the Commerce Department finds that imports threaten national security. President Trump imposed tariffs on steel, aluminum, and automobile components under this jurisdiction.

While these tariffs were not impacted by yesterday’s ruling (which is stayed pending appeal), I think it’s very clear that imports of these items constitute a national security risk. In fact, I would go further: the reality is that imports of just about any good can pose a national security risk, if the imports threaten the vitality of America’s domestic industry. Why?

The final product which people care about—at jetfighter or computer, for example—depends on an incredibly complex supply chain. A disruption at any point in the supply chain can disrupt every other link, and undermine the final product—this is akin to an O-ring vulnerability.

Ultimately, America’s national security can only be adequately protected by self-sufficiency. Imports should be considered a luxury, rather than necessary for the economy to function. Tariffs are the most sensible and least intrusive way to remedy this issue.

The Trade Act of 1974 justify varying levels of tariffs. Section 122 authorizes 15% tariffs for up to 150 days to redress trade balance issues. Meanwhile, Section 301 allows the executive to impose tariffs to remedy unfair foreign trade practices—President Trump relied on this provision successfully in his first term.

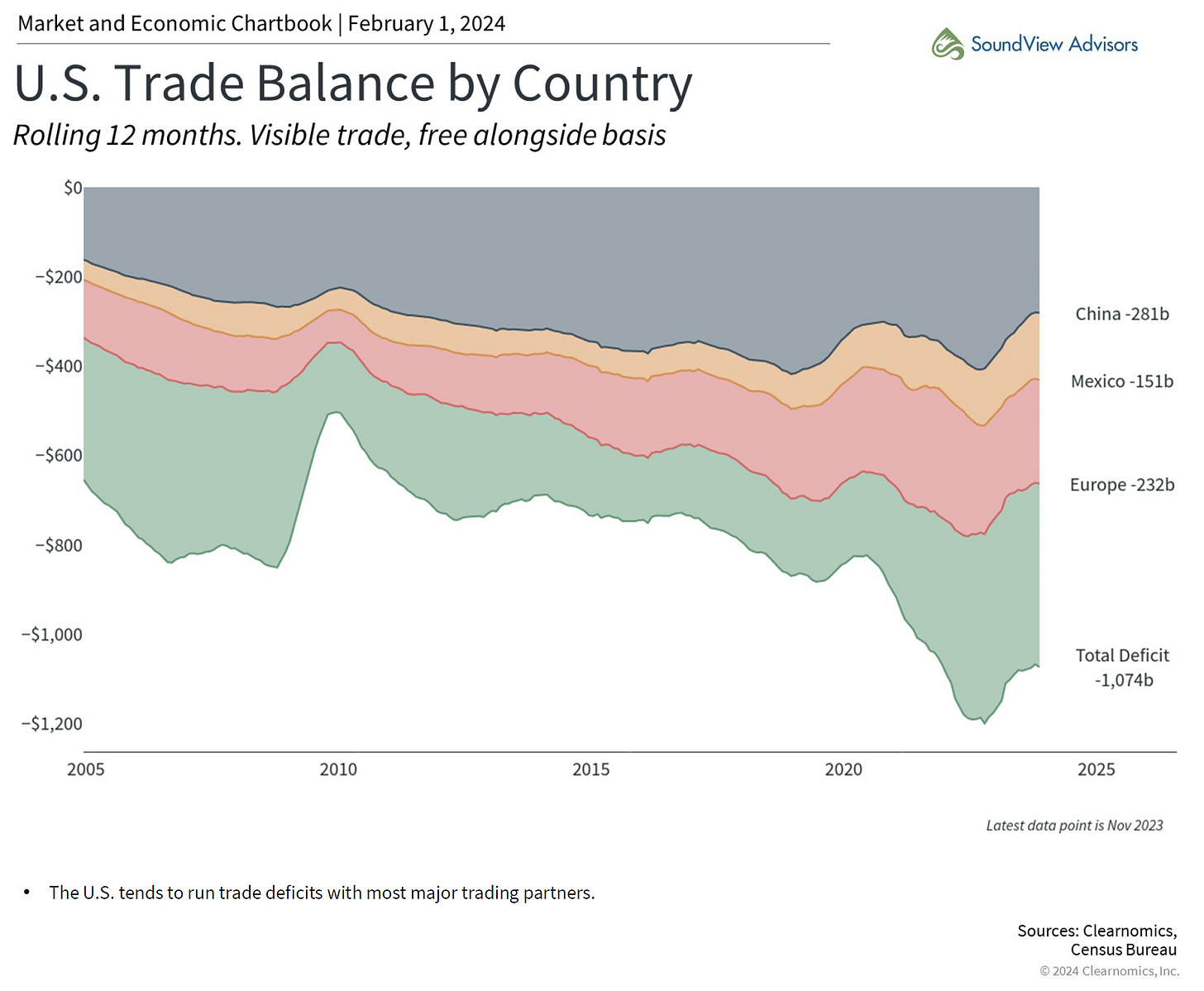

Again, America clearly has a balance of trade issue: there has been a trade deficit every year since 1974. The cumulative value of these balances, after adjusting for inflation, is over $25 trillion. Tariffs are the most effective and least intrusive way to remedy this situation.

Section 338 of the Trade Act of 1930 permits the President to impose tariffs of up to 50% if said countries are discriminating against American commerce. Although countries like Great Britain, Australia, and Canada engage in mostly free trade with America, even they discriminate against certain American goods—it is well-known that Canada viciously protects its dairy industry.

This should not only be expected—it is justified. Foreign countries have the right to protect their industries from American competition—just as America has the right to protect her industries from foreign competition.

Despite what the free trade brigade says, the factual reality is that every country on earth discriminates against American commerce in some form or fashion—whether it’s imposing tariffs or other non-monetary barriers to entry. This has been done since time immemorial.

Accordingly, President Trump would be justified in imposing tariffs on this basis.

In a perfect world, Congress would take action and protect American industry from unfair foreign competition. But that’s not going to happen. Why? Congress is bought and sold by Wall Street, the CCP, and a litany of other special interest groups who profit handsomely on America’s industrial decline.

The ray of hope is that Congress has delegated significant authority to the Executive to impose tariffs and otherwise regulate foreign commerce. President Trump was elected to fix these problems, he is trying to do so, and his remedies fall within the letter of the law.

This matter was already debated and decided in the Senate—Rand Paul lost.

The Courts should respect the Senate and the Will of the People.