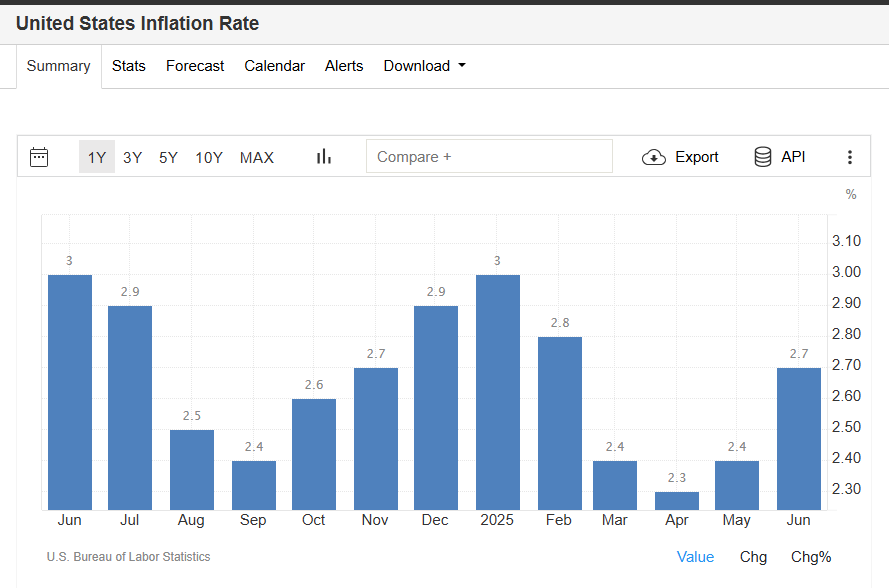

Just about every influencer, economist, and politician predicted President Trump’s tariffs would cause inflation.

Not just inflation—a tsunami of inflation that would drown consumers in a rising tide of prices.

Yet here we are enjoying a beautiful summer—and we can all still afford our lawn chairs & beach balls. Where’s the inflation?

I don’t see it. Do you? If anything, inflation’s decreased this year, relative to the same period last year. Why?

Because tariffs aren’t necessarily inflationary—probably not in the short run, and definitely not in the long run. Here’s why.

1. America is the World’s Market—This Gives Us Price Leverage

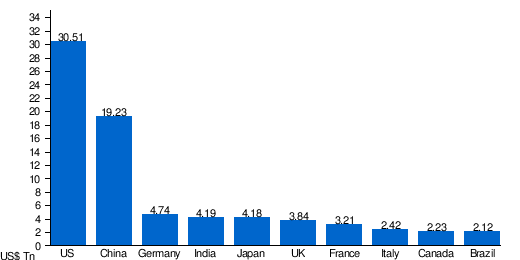

America is the biggest consumer market in the world. In 2024, Americans spent >$19 trillion on consumer goods. Over $4 trillion of this was on imports.

This means, in nominal terms, that Americans bought more than just about any other country on earth produced. America is the world’s forum, the bazaar, the emporium, the supermarket—the shopping mall.

And just like how the biggest store in town can pressure suppliers to cut costs, America’s buying power gives us leverage over prices—leverage that can be translated into profits via tariffs.

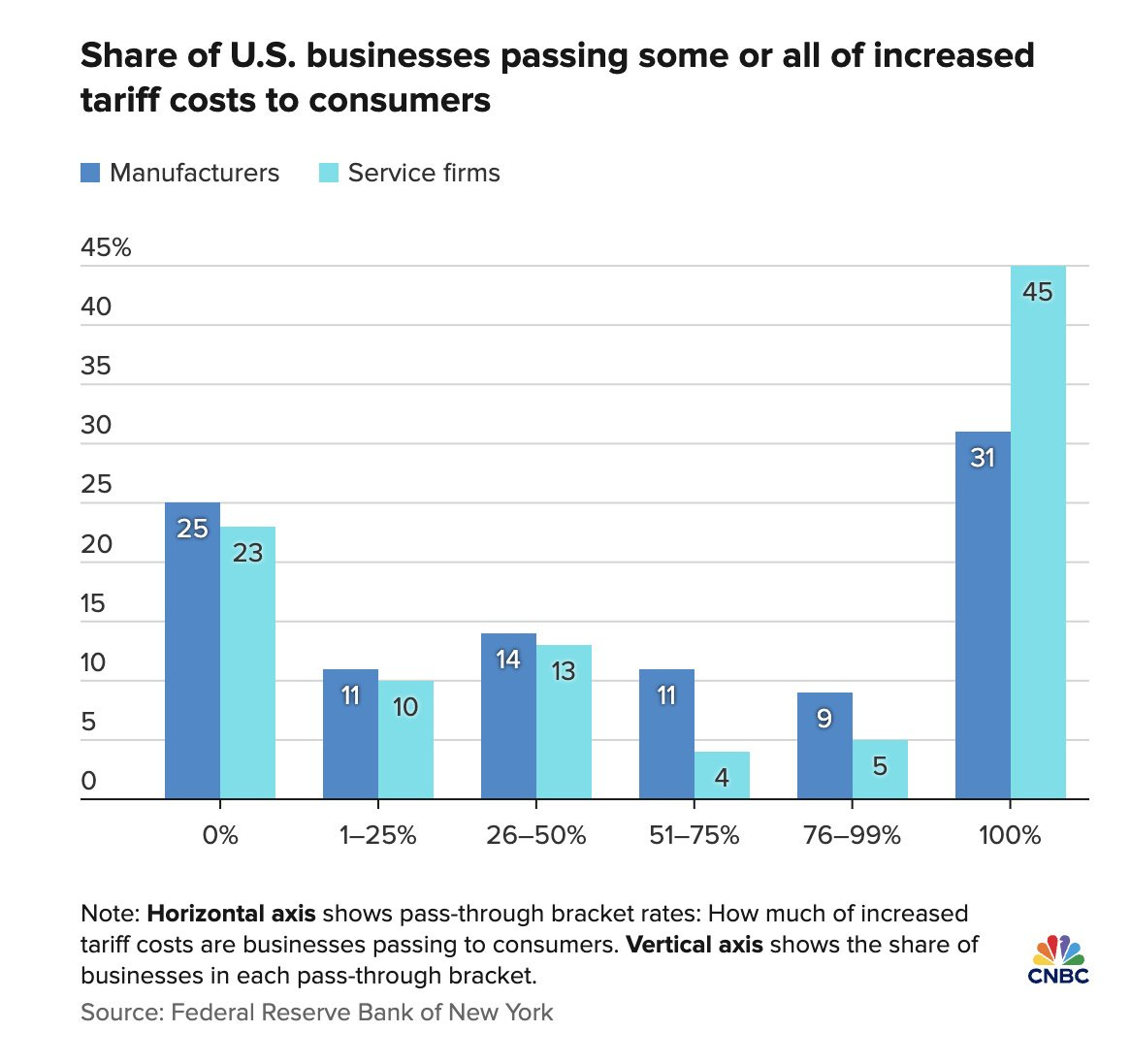

Essentially, if foreign producers want to sell their goods to American consumers—which they do—then they must pay the tariffs. However, if they raise prices too high, they will simply be outcompeted by products from countries with lower tariffs, or American producers who pay zero tariffs.

As such, there is tremendous pressure on foreign producers—particularly foreign producers in relatively high tariff, low cost countries—to eat the tariffs. This has been happening. According to recent reports, about two-thirds of manufacturers expect that foreign suppliers will eat the tariffs, rather than passing increases onto American consumers.

2. Tariffs are an Avoidable Tax—Just Buy American

Perhaps this goes without saying, but tariffs are a tax on imports. If you buy American, you do not pay tariffs.

Let’s put this into perspective: America’s GDP was nearly $30 trillion in 2024. Meanwhile, America imported $4 trillion worth of products. This means that tariffs will be applied to no more than 13% of the economy. This is unlikely to cause the sort of broad-based inflationary pressure that chicken little economists predict.

On top of that, people can simply avoid the tariffs altogether by buying American. Not only does this help to lower prices by forcing foreign competitors to lower their costs (so they can preserve price parity with American goods), but it also opens up opportunities for American producers to increase production volume.

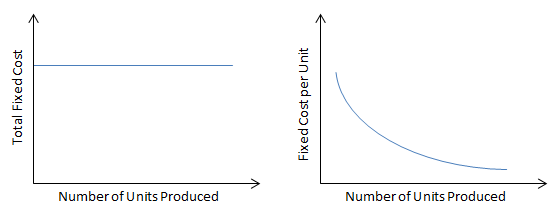

When dealing with manufactured goods, increased volume actually lowers the per unit cost of goods (this is called the law of increasing returns). Essentially, American industry can lower costs by increasing volume, party balancing out any increases caused by the tariffs.

3. Economic History Proves Tariffs Do Not Cause Long-Run Inflation

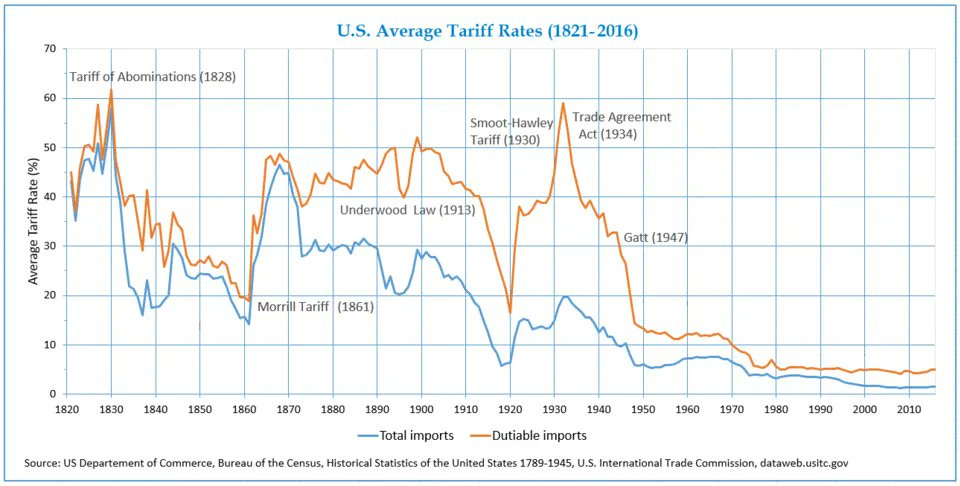

It’s important to remember that tariffs are not new. America’s Founding Fathers used tariffs to great effect, and America prospered under high tariffs for well over a century.

In fact, America had the highest average tariff rate in the Nineteenth Century—it’s not a coincidence this is when the US industrialized. By 1945 America was the world’s factory, making half of all manufactured goods. During this time—while tariffs were high—the cost of living decreased significantly.

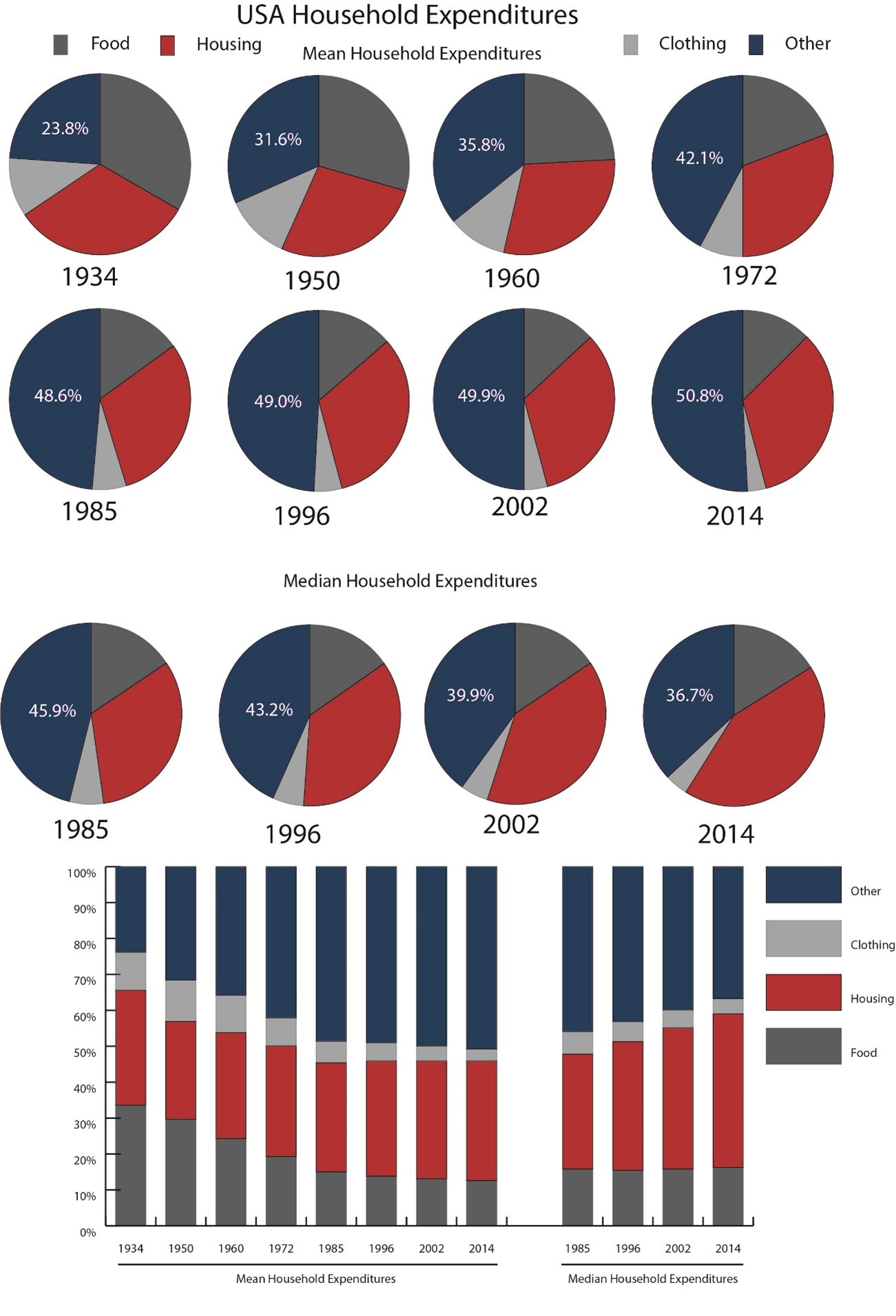

This continued into the 1900s. As you can see in the below graph, the fraction of spending on wants increased for the median American household until the 1980s, and then began decreasing.

What changed? America began the “free trade” experiment—economic globalism packaged with a libertarian-sounding name.

The cost of living decreased steadily while America had protective tariffs, and has ballooned under free trade. The data is what it is. Economists will simply have to accept it.

4. Tariffs Can Asset Inflation

Despite allegedly caring about consumer prices, the media conveniently forget that economic globalism causes inflation of a different kind.

Remember, America imports far more than it exports. This results in a trade deficit which we need to pay for. How? By selling assets and debts. As a result, the trade deficit directly contributes to the increase in prices—inflation—of American assets and debts.

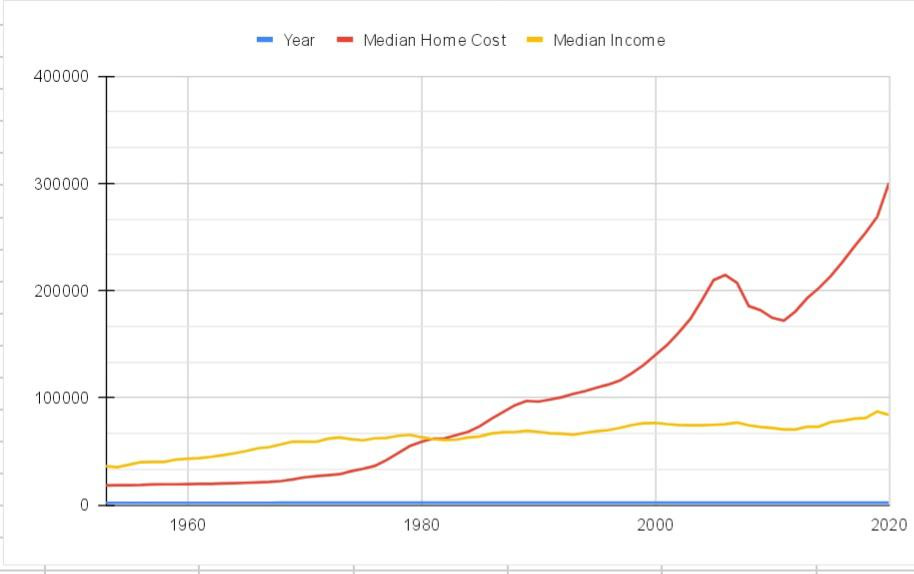

For example, in 2024 foreigners bought an estimated $42 billion of residential real estate, $8 billion of agricultural land, and $12 billion commercial real estate.

This drives up real estate prices, locking our own young people out of the real estate market—denying them their share of the American Dream.

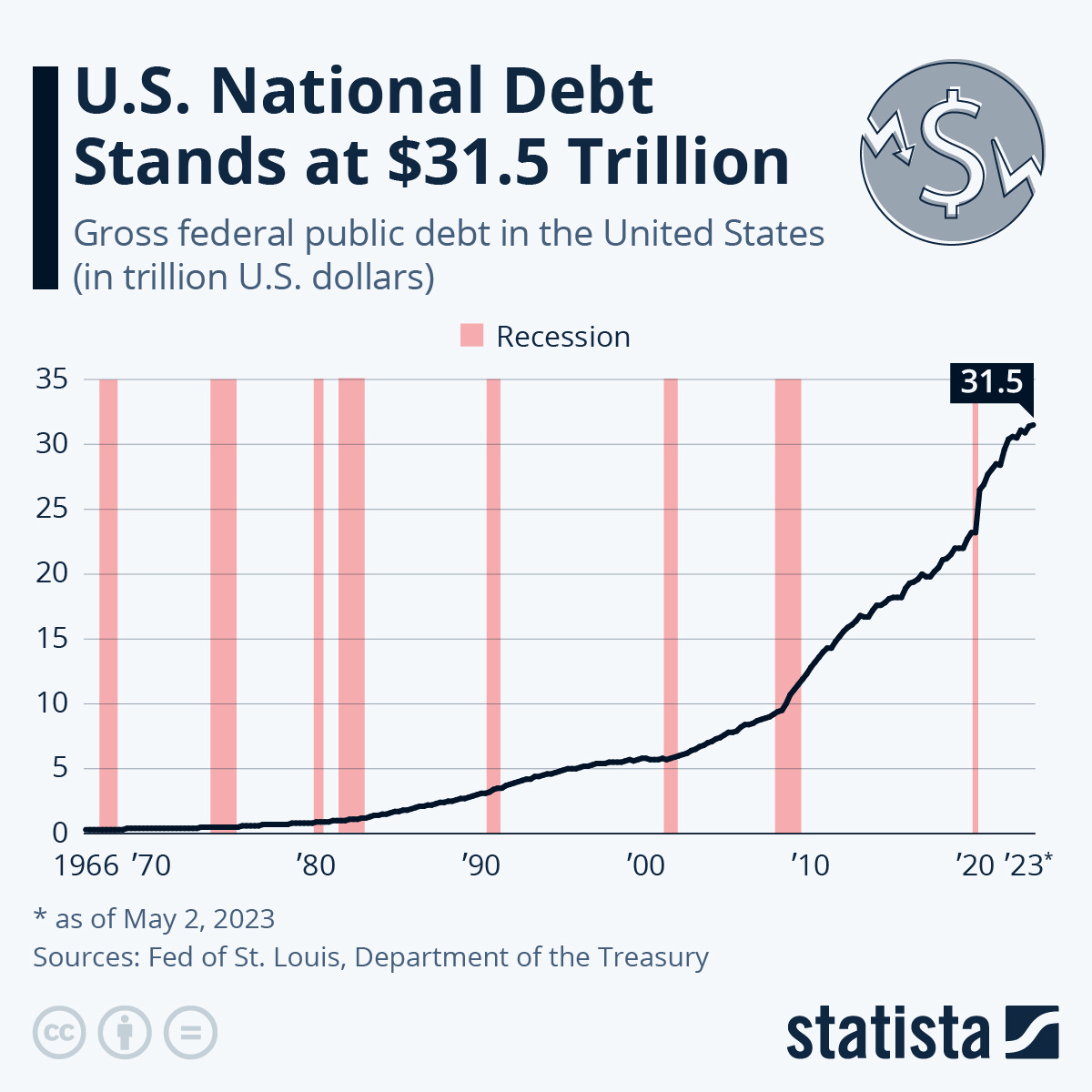

America also trades debt. This is sort of like buying groceries on our credit cards, except is occurring at the national level. For example, foreigners own some $8.67 trillion of U.S. Treasury securities, accounting for 24 percent of the public debt. Further, America’s corporate and household debt has ballooned since 1973 to the highest levels since World War 2.

Debt is especially dangerous because we have to repay the principle and we pay interest. This inflates the cost of buying foreign products in a way that most economists fail to appreciate. Consider that America became a debtor nation in 2006—for the first time since the Great Depression. As a result, we are now paying over $150 billion in interest every year to foreign entities for the privilege of buying the products we should be building.

As you can see, tariffs will not increase the costs of goods in the long run. If anything, the price of goods should begin a slow and steady decline—exactly what happened in America for almost 2 centuries under high tariffs.

Additionally, I hope you see that the whole question is framed disingenuously: the current system creates inflation—it’s just harder to see because it’s hidden in asset prices & the debt burden.

Tariffs can deflate this bubble over time, helping us to avoid economic catastrophe.

Who Cares if Tariffs Cause Inflation Anyways?

Although it’s clear that tariffs are not likely to increase prices—especially in the long run—we need to remember that pursuing “cheap goods” is not the goal. This is the point that I make in my book, Reshore: How Tariffs Will Bring Our Jobs Home & Revive the American Dream, America is not just an economy.

America is a nation. It is a people bound together by shared blood and tradition, language and culture. Even if tariffs are not economically efficient, they serve other purposes. For example, tariffs are necessary to ensure America’s economy remains self-sufficient. If not, America’s national security is gravely threatened.

We need to think about tariffs not just from the perspective of economics, but of politics. Is it truly worth surrendering our economic and political independence, in exchange for “cheap” Chinese crap?